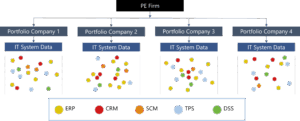

After a Private Equity (PE) firm purchases a portfolio company, visibility can be a real challenge. It’s likely all companies within a single portfolio have different IT systems and data elements which makes getting a single lens across the entire portfolio difficult. A PE firm’s portfolio view might look something like this:

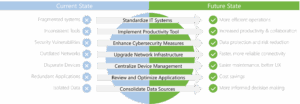

At Activera, we’re using Power Platform (Power Apps, Power Automate, Power BI) to take your portfolio view from scattered to streamlined, making it easier to organize data and gain clear insights. Some of the current-to-future state benefits include:

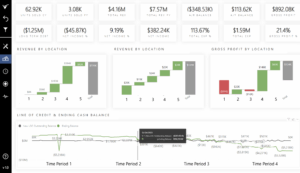

Power Platform can help PE firms gain insight across their entire portfolio and support more informed decision making. The single pane of glass view, with consistent data elements, creates dashboards PE executives can rely on for decision support.

Power Platform can help PE firms gain insight across their entire portfolio and support more informed decision making. The single pane of glass view, with consistent data elements, creates dashboards PE executives can rely on for decision support.

We recommend Power Platform as a way for PE firms to enhance their decision-making across disparate entities. Whether the firm wants to assess performance or identify opportunities, Power Platform supports firms with the organized, consistent information they need to drive growth across their portfolio.