The best way to provide solid rigor around your project, prove value to management, and gain advocates throughout the enterprise is to build a Business Case. A Business Case can be defined as an evaluative approach to calculate and showcase the fair outcome of a project or initiative, most times using financial concepts such as Net Present Value (NPV), Internal Rate of Return (IRR), and payback period.

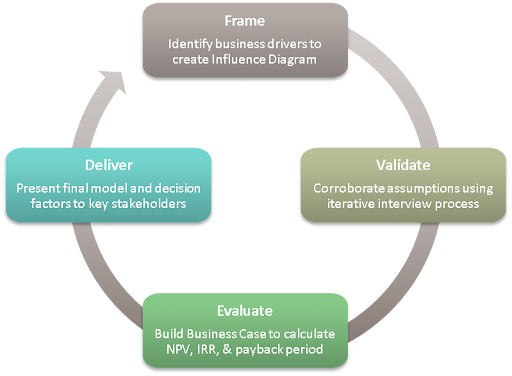

Project initiation, regardless of complexity level or market environment, can boost or hinder eventual execution. It is an interesting journey because, many times, we intuitively know the manifold benefits in executing a certain project, but seldom know how to present tangible returns to the key sponsors. An effective process for doing so is outlined below:

Frame – The first step to proving your project’s value is to outline the key costs and benefits in an Influence Diagram, which becomes a framework for the Business Case. The Influence Diagram breaks down your NPV into One-time Costs (e.g. New Hardware), Ongoing Costs (e.g. Software Licenses), and Benefits (e.g. Drilling Day Reduction; Increased Production). You will need a knowledgeable group of both business and technical Subject Matter Experts (SMEs) to ensure process-oriented and technically feasible benefits/costs are identified. Examples of benefits, to get the juices flowing, can include: process improvement, reduced downtime, concurrent engineering, and application rationalization. Concentrate on concrete benefits that can be quantitatively exhibited. A note of caution, concepts such as productivity increase are considered “soft” benefits and can reduce management buy-in if they dominate your Business Case’s landscape. Once complete, the Influence Diagram will guide you down the path of stakeholder elicitation and validation with ease.

Validate – Elicitation is the iterative process of identifying and engaging stakeholders and SMEs to flesh out specific estimations to be entered into the Business Case calculations. In these interviews, it is essential to ask relevant questions to understand the effort and costs for each aspect of the outlined benefits. It is recommended to get ranges for each of the assumptions defined during this process (e.g. P10, P50, P90).

Ranges are needed because Business Cases are, though rigorously vetted, inherently based on assumptions. Decision makers will want to know base case, best case, and worst case scenarios.

Evaluate – Developing a Business Case model for a project will lead to a financial decision based on the Net Present Value. This NPV is calculated based on costs and benefits discovered in the initial analysis. To get to the financial decision-making point for a project, all benefits and costs should be set up in an excel model that will help calculate the NPV and some other decision factors such as ROI, payback period, and IRR.

Each of the assumptions related to the costs and benefits are loaded in the Business Case model as probabilistic values based on the ranges identified in the Validate phase, and a Monte Carlo simulation is run to find the best fit NPV.

Deliver – Now that proper rigor has resulted in a positive NPV, make sure to share the results with your Decision Executive and Project Sponsor. Additionally, wrap a bow around the Business Case for stakeholders/SMEs and present it to them with an accompanying PowerPoint describing a use case that will resonate with their managers. By doing so, you will enable a project advocate with apropos tools, gain a strong supporter to socialize the project with their peers, and demonstrate benefit to potential financial decision-makers.

A Business Case not only evaluates a project and ensures that stakeholders understand the value, but it also certifies that enough time was spent in the initial analysis of the project. This, in turn, leads to effective implementation, for which there is no substitute. With a well-designed Business Case in hand, staunch supporters across the organization, and proven value, success is within sight.